Introduction

As a leader in a company running on the EOS®, you know that beating the competition isn’t just about growing revenue but maximizing profit. This means making smart decisions to improve efficiency, cut costs, and seize growth opportunities. Strategic financial management is essential.

Introducing FP&A as a Strategic Tool

Unlike traditional financial management, which looks backward, FP&A looks ahead. It provides a roadmap for your business and shows how to reach your goals efficiently. Using FP&A techniques, you can anticipate market changes, allocate resources wisely, and reduce risks before they affect your bottom line.

Understanding FP&A and Its Role in Growing Profits

What is FP&A?

FP&A goes beyond standard accounting to drive profit growth. FP&A includes budgeting, financial forecasting, financial analysis, and strategic planning. It turns data into actionable insights, helping you make informed decisions to move your business forward.

Components of FP&A:

- Budgeting

Creating a detailed financial plan outlining expected revenues and expenses over a set period.

- Forecasting

Predicting future financial performance based on past data, market trends, and economic indicators.

- Financial Analysis

Evaluating financial statements and ratios to assess company performance and health.

- Strategic Planning

Aligning financial goals with long-term business objectives, including growth initiatives and market expansion.

The Strategic Value of FP&A for Businesses Running on EOS®

Informing Decisions and Aligning with Business Goals

FP&A offers a complete view of your company’s financial landscape. You can make informed decisions that align with your objectives by analyzing data and trends. Whether launching a new product, entering a new market, or optimizing operations, FP&A ensures financial considerations are part of your strategic planning.

Identifying Growth Opportunities and Mitigating Risks

At the same time, FP&A helps identify potential risks—like cash flow issues or market downturns—so you can take steps to reduce them.

How to Conduct a Strategic Financial Analysis

Conducting a strategic financial analysis involves a comprehensive evaluation of your company’s financial data to inform high-level decision-making. Here’s a step-by-step approach:

- Gather Financial Statements

Collect income statements, balance sheets, accounts receivable aging reports, and cash flow statements from the past 3-5 years.

- Perform Ratio Analysis

- Profitability Ratios: Gross Profit Margin & EBITDA Margin

- Liquidity Ratios: Current Ratio & Cash Burn Rate

- Leverage Ratios: Debt-to-Equity Ratio

- Efficiency Ratios: Team Utilization Rate (Service Businesses), Inventory Turnover (Product Businesses), & Receivables Turnover

- Trend Analysis

- Identify Patterns: Look for consistent growth or decline in key metrics.

- Benchmarking: Compare against industry standards and competitors.

- SWOT Analysis

- Strengths and Weaknesses: Internal financial capabilities.

- Opportunities and Threats: External economic factors and market conditions.

- Financial Forecasting

- Revenue Projections: Based on market analysis and sales trends.

- Expense Forecasting: Anticipate costs linked to growth initiatives.

- Cash Flow Projections: Ensure liquidity for operations and investments.

- Scenario Planning

- Prepare for best-case, worst-case, and most likely market conditions.

- Assess the impact of adverse economic events.

- Develop Strategic Initiatives

- Cost Optimization: Identify areas to reduce expenses without sacrificing quality.

- Revenue Enhancement: Explore new markets or product lines.

- Capital Structure Improvement: Optimize debt and equity balance.

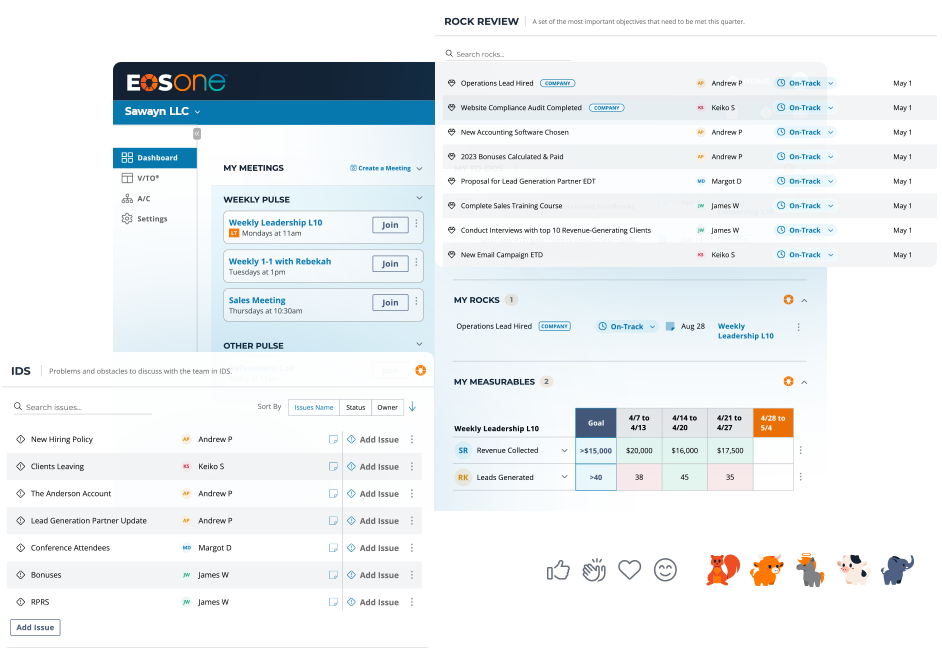

- Align with EOS Rocks

- V/TO Alignment: Ensure strategies support your 1-, 3-, and 10-year goals.

- Scorecard Metrics: Establish KPIs to track progress.

- Implement and Monitor

- Assign responsibilities and timelines.

- Hold regular reviews to adjust as needed.

By analyzing your financial position and integrating strategic planning, you can make proactive decisions that drive growth and profitability.

Leveraging Strategic Financial Consulting

The Value of a Fractional CFO

A Fractional CFO is a financial expert who provides CFO-level services on a part-time or contract basis. They offer strategic financial leadership without the cost of a full-time executive.

Scope of Work

- Financial Strategy Development

- Budgeting and Forecasting

- Cash Flow Management

- Financial Reporting and Analysis

- Risk Management

Differences from Full-Time CFOs

- Flexibility: Engage services as needed.

- Cost-Effective: Pay only for the services required.

- Expertise: Access high-level skills without a long-term commitment.

Benefits of Hiring a Fractional CFO

- High-Level Expertise: Gain insights from seasoned professionals.

- Cost-Effectiveness: Ideal for companies not ready for a full-time CFO salary.

- Scalability: Adjust engagement based on business needs.

- Objective Perspective: Receive unbiased advice and fresh viewpoints.

How a Fractional CFO Enhances FP&A Practices

Strategic Insights:

- Budgeting: Implement advanced techniques like zero-based budgeting

- Forecasting: Improve accuracy with rolling forecasts and scenario planning

- Financial Analysis: Utilize sophisticated tools to analyze financial ratios and KPIs

Conclusion

Now is the time to implement the strategies outlined in this playbook. Start by assessing your current financial processes, investing in the right tools and talent, and engaging your team in embracing FP&A practices.Ready to unlock your business’s full potential? Contact us today to learn how Fractional CFO services can help you achieve your financial goals and drive strategic growth.