As a small to medium-sized business owner, you’ve likely experienced the frustration of inconsistent profits and cash flow. You’re not alone. Many entrepreneurs struggle to understand why their financial performance fluctuates, even when sales seem strong.

The key lies in mastering cash flow management. Here are five tips to help you navigate inconsistencies in profits and strategically manage your cash flow.

- Understand Your Financial Position

The foundation of effective cash flow management is having a clear understanding of your financial position. Well-run companies have clarity in their financials, knowing their revenues, profits, and overall performance at the end of each month.

To achieve this clarity, close your books by the 10th of each month and review three key financial statements:

- Income Statement

- Balance Sheet

- Cash Flow Statement

These documents provide a comprehensive view of your operational performance, assets and liabilities, and cash position. Having this information readily available allows you to make informed decisions and quickly address any issues that arise.

- Focus on Enterprise Value

While some entrepreneurs are content with maintaining a stable lifestyle business, growth-oriented entrepreneurs should always keep an eye on increasing their company’s enterprise value. This focus is crucial because it’s good business strategy to increase your company’s value every quarter and year. Higher enterprise value provides more options for reinvestment or a potential exit, and it ensures you’re maximizing the return on your entrepreneurial efforts.

Consider this saying: “Sales is vanity, profits is sanity, and cash flow is king.”

While increasing sales is important, it’s crucial to focus on profitability and maintaining strong cash flow to truly build long-term value.

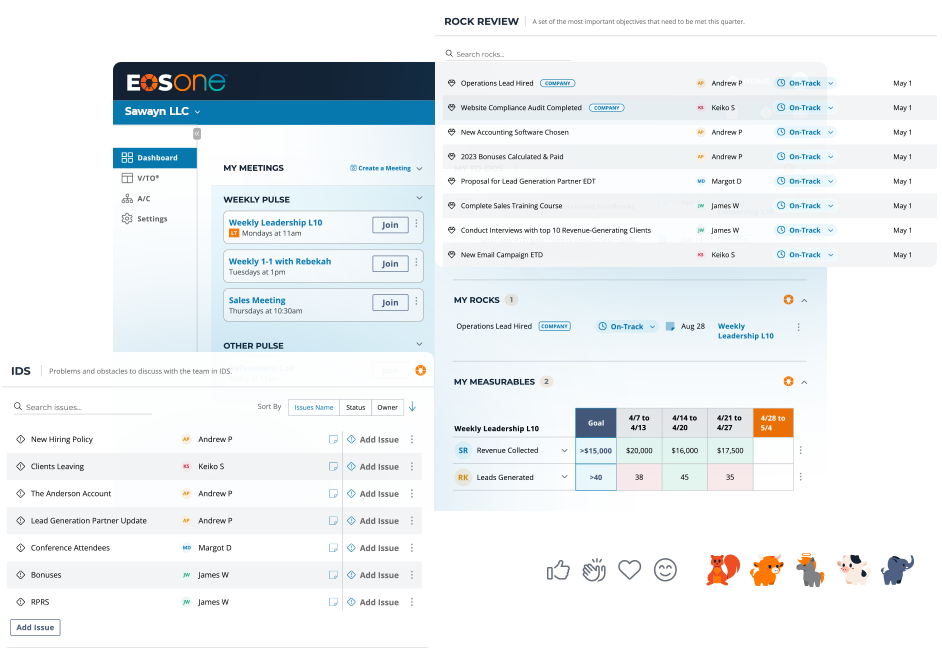

- Implement the Entrepreneurial Operating System (EOS)

EOS is a comprehensive business management system that can significantly improve your cash flow management. EOS helps you take a holistic approach to managing cash flow by aligning your team, setting clear goals, and focusing on the most impactful areas for improvement.

Key aspects of EOS that relate to cash flow include:

- Quarterly financial reviews: Regularly assess your top-line revenue and bottom-line profit against targets.

- Accountability chart: Ensure you have the right people in the right financial roles.

- Cash flow drivers: Utilize tools like the “Power of One” to review the seven levers of cash flow you can impact.

EOS emphasizes the importance of understanding and manipulating seven key levers that impact your cash flow. These levers provide a comprehensive framework for analyzing and improving your financial performance. They include:

- Price: The amount you charge for your products or services. Even small increases in price can significantly impact your cash flow, assuming volume remains stable.

- Volume: The quantity of goods or services you sell. Increasing sales volume can boost cash flow, but it’s important to consider the associated costs.

- Cost of Goods Sold (COGS): The direct costs associated with producing your goods or services. Reducing COGS can improve your profit margin and cash flow.

- Operating Expenses: Your overhead costs. Trimming unnecessary expenses can have a direct positive impact on cash flow.

- Accounts Receivable: The time it takes to collect payment from customers. Shortening this cycle can dramatically improve your cash position.

- Accounts Payable: The time you take to pay suppliers. Extending this period (within reason and while maintaining good relationships) can help manage cash flow.

- Inventory: The amount of stock you hold. Optimizing inventory levels ensures you’re not tying up too much cash in unsold goods.

By regularly reviewing these levers in your quarterly EOS meetings, you can identify which areas have the most potential for improving your cash flow, which allows you to develop targeted strategies and action plans to optimize each lever.

The power of this approach lies in its comprehensive nature and its focus on actionable metrics. By understanding and actively managing these seven levers, you can make informed decisions that drive continuous improvement in your cash flow management, ultimately building greater enterprise value over time.

- Leverage External Expertise

Consider bringing in a fractional CFO if your internal team lacks the expertise to provide accurate and timely financial data. A fractional CFO adds another dimension to your financial management, helping you dig deeper into the numbers and develop actionable plans to optimize your cash flow.

A finance professional can:

- Ensure your financial statements are accurate and up to date

- Provide in-depth analysis of your financial performance

- Identify low-hanging fruit and problem areas

- Recommend strategies for improvement

Key Takeaways for Mastering Cash Flow Management

To master cash flow management, start by prioritizing accurate and timely financial reporting, and don’t hesitate to seek external expertise if your internal team needs support. Implement a system like EOS to regularly review and improve your financial performance and focus on the seven levers of cash flow to identify areas for improvement.

As you make financial decisions, always keep enterprise value in mind, understanding that strong cash flow management is essential for your ongoing operations and potential future exits. By following these key principles, you’ll be better equipped to navigate the challenges of entrepreneurship, seize growth opportunities, and build a more valuable business over time.