*To help our readers navigate their businesses and organizations during the COVID-19 pandemic, we are re-posting this relevant blog post from Ken DeWitt, previously published on the DeWitt LLC blog.

Many of my clients are downright angry about America’s coronavirus shutdown. Initial reactions include disbelief and anger at the news media or politicians and frustration with the perceived gullibility of large numbers of people who are giving in to panic. Logic is out the window, and fear is palpable.

I’ve been checking in on my current clients more frequently since this crisis began, and they always ask me what I think about the situation.

Simply stated, I’m a realist.

Regardless of how we got here or who is responsible, we are here: facing a “black swan” event that is disrupting our lives, shaking the confidence of family, employees, and communities, and will imperil many of our businesses.

But economically speaking, we’ve been here several times before. While this event might seem unprecedented, what we might go through is nothing new.

“Chinese Imports Don’t Affect My Supply Chain, So I’m Not Worried.”

A lot of optimists are unconcerned because what happens with China has no direct relation to their business. But the possibility of an economic recession is real for everyone. NOW is the time to be prepared with a survival plan, whether that happens or not.

In the last recession, the businesses that got slaughtered were the ones that delayed critical actions; the doomed “optimists” in the Stockdale Paradox as described by Jim Collins in Good to Great. Collins explains it in this video, but simply stated if we are to survive, we must:

- Have faith that we will endure through hardships and will prevail in the end

- Hold to this faith without wavering, while still confronting the brutal realities of our current situation.

In short, DENIAL IS NOT AN OPTION.

Survival Checklist

For many years before I discovered EOS®, I was a practicing turnaround professional. I took broken, distressed companies and helped them make tough, survival-minded decisions for recovery. You may be a healthy business now, but you will have to make those same decisions if you want to remain one through uncertain times.

Do-It-NOW Recession-Planning Checklist:

1. Stay focused and completely disciplined.

Exercise the kind of discipline you would have to exercise if you were in a turnaround situation. Since you run on EOS, you know what to be disciplined about. Everything else is “just an issue” you must live with, change, or end. Whatever happens, stay focused! DON’T do this:

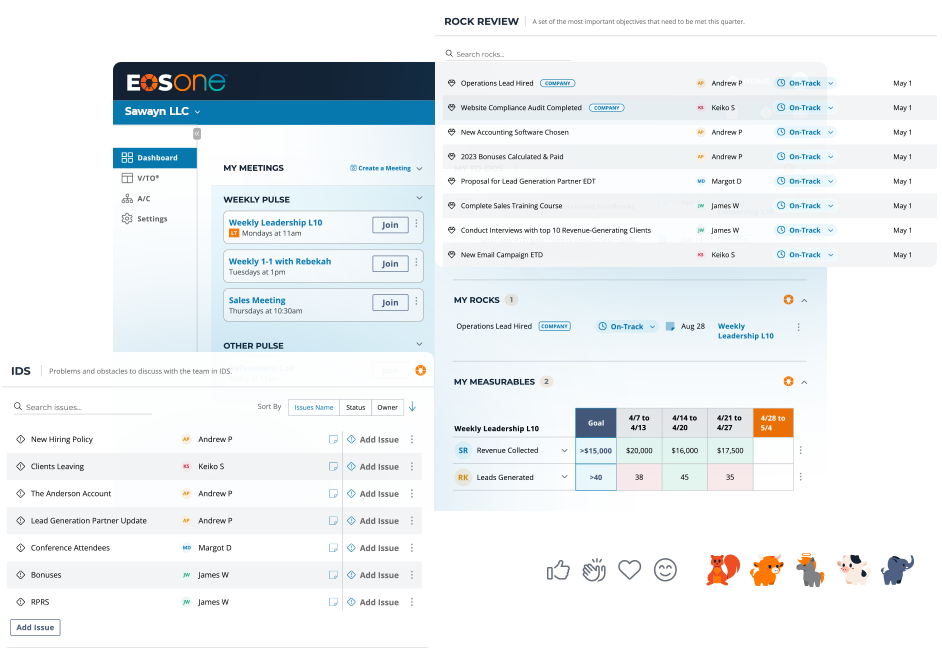

2. Make contingency, scenario, and cash planning a recurring IDS topic in your leadership team Level 10 Meetings™ EVERY WEEK.

My fellow EOS Implementer, Victoria Cabot, shares key questions to ask in this article on LinkedIn. Cascade messages as necessary to employees, departments, customers, vendors, and banks.

3. Prepare to be the leader your company, family, and community need.

Read my recent memo to Visionaries and Integrators on how to be a leader in a crisis. Ensure that every leader in your company hears this message and is prepared mentally. Practically speaking, consider production cross-training now so you’ll be prepared if significant parts of your frontline cannot show up due to illness. Management and sales may be called in for an all-hands-on-deck situation to get production done.

4. Decide in advance – NOW – how much you can do to help your employees through the crisis.

What is your sick leave policy? How can you extend that? Can they take vacation time after sick time? What can you afford before having to make any temporary pay changes or reductions in force? Be generous, but don’t leave it open-ended.

5. Prepare an alternate Accountability Chart for various contingencies.

When we planned your growth, we looked forward six to twelve months and determined key functions, who is critical to your success, and whether each seat was filled with a Right Person.

First, do your People Analyzers now and know who is a Right Person in a Right Seat.

Second, prepare an Accountability Chart to reflect the structure you will need IF your business revenue declines, for example, by 20%. Do as many iterations as you need to help with your personnel planning.

6. Get good at weekly cash forecasting.

We EOS companies think in 90-day periods — 13 weeks at a glance in our Scorecards. That’s short-term. The long-term is beyond 90 days. You’ll want to ask someone to do cash flow forecasting (Do a monthly version for your personal/family finances.) At all times, know how much cash you have, how much you will need when you will need it, and where it will come from. Examine your lines of credit, and ensure they will be there for you. Review possible personal shareholder cash injections.

7. Watch your Scorecards with new diligence.

As an EOS company, this is your early warning system that will forecast any trouble. “Drop it down,” missed goals will need to be IDS-ed as soon as possible, and your leaders will need help driving your key measurables as well as possible under the circumstances.

This Will Be A Very Fluid Situation, To Say The Least!

Factor all of the above into your 13-Week Cash Flow Plan and present it weekly in your leadership team Level 10. Help your accountant and employees see that “approximately right and fast” is acceptable; “slow and perfect” is NOT. And if you need a contract CFO to do your forecasting, contact your EOS Implementer for help finding one. Many Implementers know CFOs who will be happy to assist you with developing a sound plan forward without a long-term engagement.

NEXT STEPS:

- Download the Issues Solving Track™ from the EOS Toolbox to learn how to IDS (Identify, Discuss, and Solve) issues more effectively.

- Learn to make decisions faster and better by downloading a copy of our free EOS eBook, Decide!

- Download a free chapter of Traction by Gino Wickman