This is not a post about buying and flipping property.

This is not a post about how to claim money left at an airport by a distant Uncle that needs your help to transfer it into the US.

This is not a post about working harder to sell more or put in 20,000 more steps a day to remind everyone how to do their jobs more efficiently.

This is a post for the entrepreneurs out there challenged to get their teams to make decisions like they owned the business. This is about the one thing that will have the biggest impact on the financial performance of your business: Sharing, teaching, and repeating those two things forever.

An Introduction to the Process

Money and financial standing are often the root of the biggest “why” when making any business decision. Financial knowledge and understanding of finance’s impact on your business is critical to having a healthy company. In my last blog I talked about how your leadership team needs to teach managers about exactly how your company turns a profit, and that’s especially applicable here. This knowledge allows your team to understand and think critically.

But what about when revenue is falling, or you feel like you’re losing out on profit somewhere in your processes, or—worse yet—your cash reserves are getting close to the red line? Financial understanding lays the groundwork for harder conversations, like taking advantage of EOS’s 8 Cash Flow Drivers™ tool. Here’s a little insight into how that process works.

Step 1: Brainstorm Your Financial Drivers

The process starts with bringing your leadership team together to brainstorm what your company’s key drivers of profit and cash flow are. The most critical thing to understand about this process is that it is a pure brainstorm. It does not start with your list or the finance lead’s list; that is telling, NOT TEACHING. Go around the room once and have everyone share two items on their list that have not already been said.

Finalize this step by going through each one and ask, “Is this one of our eight critical drivers of cash/profit?” Discuss and make a decision, yes or no. If yes, look at other ideas that fall under the umbrella of that driver and erase them. In this step, it’s critical for everyone to be 100% on the same page about the words you use and what they mean. Names matter, and you have to align with what you will call the measure and how you all define it (in particular, what is included and not included in the metric). With your list of eight drivers finalized, step one is complete.

Step 2: Establish Ownership & Set Goals

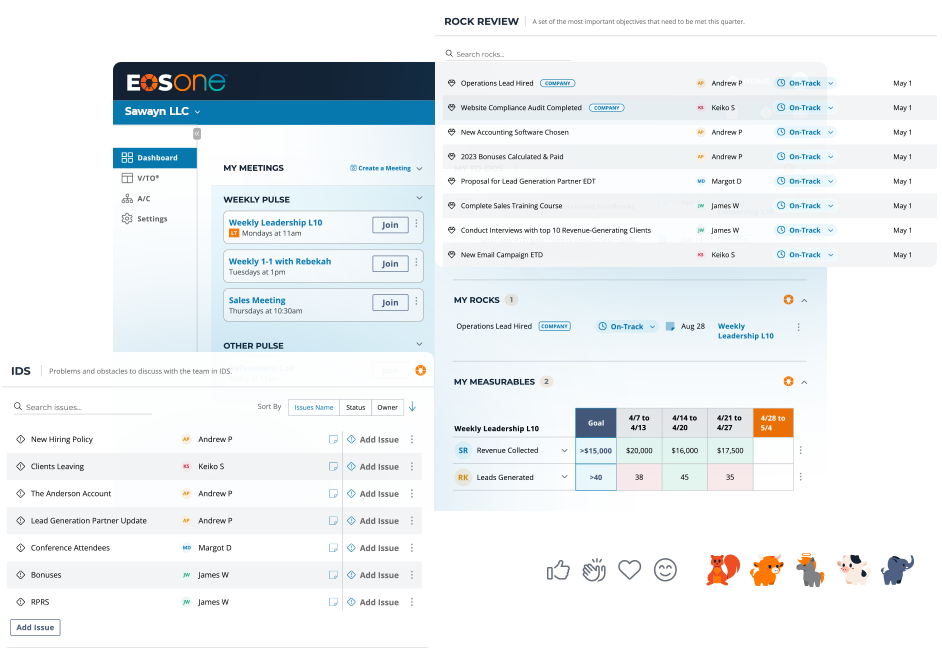

Once your list is complete, this step is about applying one of our core beliefs in EOS: “If two people are accountable for a number, then nobody is accountable.” Go back around and identify the person who owns the metric associated with each driver. Looking at the Accountability Chart™ should make this step easy.

Not only is it important for the owner to know they’re the owner, they also need to know what they’re responsible for achieving. The second part of this step is to identify a goal for each number. This could be a target number, a percentage change, or some other measurable improvement goal for the year.

Step 3: Determine How Financial Goals are Tracked

There are three common places where organizations track progress toward their goals: scorecard, profit and loss statement, or the budget. If a tracking mechanism or place does not exist, put it on the issues list and make it a rock. For example, 90% of my EOS clients don’t have a formal budgeting process when they start EOS. Sometimes building the systems or processes have to happen first before this can be more easily tracked. Work with your team to establish the best way to teach each of your cash flow driver goals.

Step 4: Create Ongoing Leadership Training

This is the most-often missed step. If you watch my video related to the 8 Cash Drivers Tool, you’ll hear me stress the teaching part of the finance lead’s role. In another video sharing the 4 Videos Every Visionary / Founder Should Make, this step is at the center of each message I share.

Don’t let creativity be a barrier, just do something.

When I stepped into a leadership role at an entrepreneurial company, I partnered with our CFO to create a tool called Follow The Dollar. I used it to brainstorm, teach, and ask questions of the leadership team. Then I split the leadership team up and had them create a skit to teach what they learned.

We video taped all of the answers, picked a winner, gave a prize, and used that video in onboarding going forward. Have some fun! But, more importantly, be committed to teaching this to all your leaders, and—where appropriate—all of your people.

Your Great Commission: Get Comfortable With Discomfort

<!– /wp:heading –> <!– wp:paragraph –>

It’s easy to lean back on “how we’ve always done things.” It takes effort to evaluate what isn’t working anymore and actually change it, but plenty of companies have already used the 8 Cash Flow Drivers tool successfully! If you’re willing to take the leap, you might be surprised just how much it positively impacts your business long-term.